[ad_1]

Our objective right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” under, is to provide the instruments and confidence you must enhance your funds. Though we do promote merchandise from our companion lenders, all opinions are our personal.

The most recent traits in rates of interest for private loans from the Credible market, up to date weekly. (iStock)

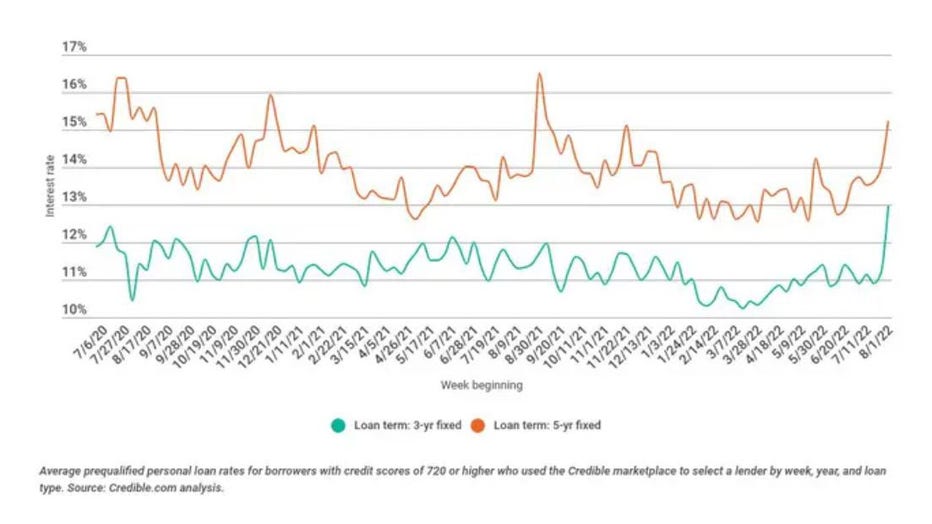

Debtors with good credit score in search of private loans in the course of the previous seven days prequalified for charges that had been increased for each 3- and 5-year loans in comparison with the earlier seven days.

For debtors with credit score scores of 720 or increased who used the Credible market to pick a lender between August 1 and August 7:

- Charges on 3-year fixed-rate loans averaged 11.13%, up from 10.82% the seven days earlier than and down from 11.53% a yr in the past.

- Charges on 5-year fixed-rate loans averaged 15.53%, up from 14.18% the earlier seven days and up from 13.71% a yr in the past.

Private loans have develop into a preferred strategy to consolidate and repay bank card debt and different loans. They will also be used to cowl surprising bills like medical payments, deal with a serious buy or fund residence enchancment tasks.

Charges for each 3- and 5-year fixed-rate private loans rose over the past seven days, with charges for 3-year phrases growing by 0.31%, and charges for 5-year phrases rising by 1.35%. Regardless of the will increase, charges for 3-year private loans are decrease than they had been a yr in the past. Debtors can reap the benefits of curiosity financial savings with a 3-year private mortgage proper now. Nonetheless, each mortgage phrases supply rates of interest considerably decrease than higher-cost borrowing choices like bank cards.

Whether or not a private mortgage is best for you typically depends upon a number of elements, together with what charge you possibly can qualify for. Evaluating a number of lenders and their charges might assist make sure you get the very best private mortgage to your wants.

It is at all times a good suggestion to comparability store on websites like Credible to grasp how a lot you qualify for and select the most suitable choice for you.

Listed below are the newest traits in private mortgage rates of interest from the Credible market, up to date month-to-month.

Private mortgage weekly charges traits

The chart above exhibits common prequalified charges for debtors with credit score scores of 720 or increased who used the Credible market to pick a lender.

For the month of July 2022:

- Charges on 3-year private loans averaged 11.04%, down from 11.1% in June.

- Charges on 5-year private loans averaged 13.72%, up from 13.13% in June.

Charges on private loans fluctuate significantly by credit score rating and mortgage time period. In case you’re inquisitive about what sort of private mortgage charges you might qualify for, you should use a web based instrument like Credible to check choices from completely different non-public lenders. Checking your charges will not have an effect on your credit score rating.

All Credible market lenders supply fixed-rate loans at aggressive charges. As a result of lenders use completely different strategies to guage debtors, it’s a good suggestion to request private mortgage charges from a number of lenders so you possibly can examine your choices.

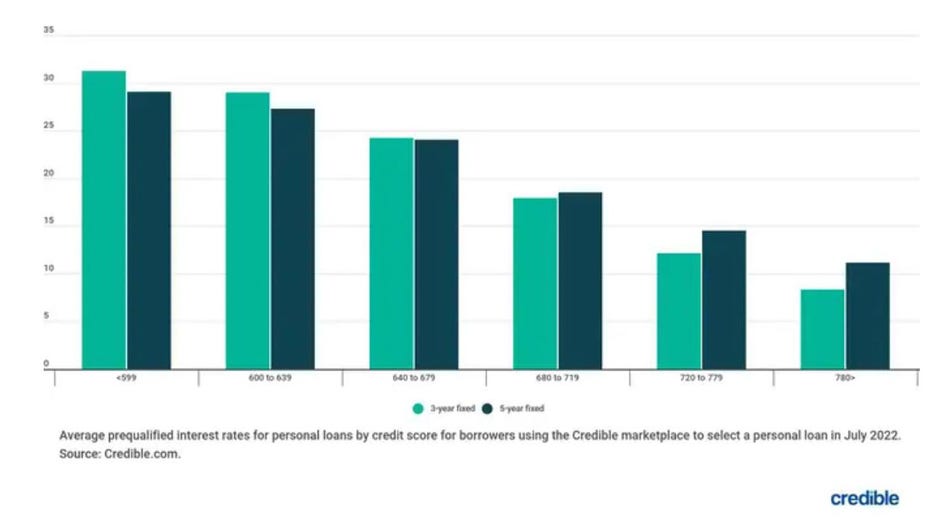

Present private mortgage charges by credit score rating

In July, the common prequalified charge chosen by debtors was:

- 8.34% for debtors with credit score scores of 780 or above selecting a 3-year mortgage

- 29.09% for debtors with credit score scores under 600 selecting a 5-year mortgage

Relying on elements comparable to your credit score rating, which kind of non-public mortgage you’re in search of and the mortgage reimbursement time period, the rate of interest can differ.

As proven within the chart above, credit score rating can imply a decrease rate of interest, and charges are typically increased on loans with mounted rates of interest and longer reimbursement phrases.

Easy methods to get a decrease rate of interest

Many elements affect the rate of interest a lender would possibly give you on a private mortgage. However you possibly can take some steps to spice up your possibilities of getting a decrease rate of interest. Listed below are some ways to strive.

Enhance credit score rating

Typically, individuals with increased credit score scores qualify for decrease rates of interest. Steps that may allow you to enhance your credit score rating over time embrace:

- Pay payments on time. Fee historical past is crucial consider your credit score rating. Pay all of your payments on time for the quantity due.

- Verify your credit score report. Have a look at your credit score report to make sure there aren’t any errors on it. In case you discover errors, dispute them with the credit score bureau.

- Decrease your credit score utilization ratio. Paying down bank card debt can enhance this vital credit score scoring issue.

- Keep away from opening new credit score accounts. Solely apply for and open credit score accounts you really need. Too many exhausting inquiries in your credit score report in a brief period of time might decrease your credit score rating.

Select a shorter mortgage time period

Private mortgage reimbursement phrases can fluctuate from one to a number of years. Typically, shorter phrases include decrease rates of interest, because the lender’s cash is in danger for a shorter time frame.

In case your monetary scenario permits, making use of for a shorter time period might allow you to rating a decrease rate of interest. Have in mind the shorter time period doesn’t simply profit the lender – by selecting a shorter reimbursement time period, you’ll pay much less curiosity over the lifetime of the mortgage.

Get a cosigner

Chances are you’ll be accustomed to the idea of a cosigner if in case you have scholar loans. In case your credit score isn’t ok to qualify for the very best private mortgage rates of interest, discovering a cosigner with good credit score might allow you to safe a decrease rate of interest.

Simply bear in mind, in case you default on the mortgage, your cosigner shall be on the hook to repay it. And cosigning for a mortgage might additionally have an effect on their credit score rating.

Evaluate charges from completely different lenders

Earlier than making use of for a private mortgage, it’s a good suggestion to buy round and examine provides from a number of completely different lenders to get the bottom charges. On-line lenders usually supply probably the most aggressive charges – and may be faster to disburse your mortgage than a brick-and-mortar institution.

However don’t fear, evaluating charges and phrases doesn’t should be a time-consuming course of.

Credible makes it straightforward. Simply enter how a lot you need to borrow and also you’ll be capable to examine a number of lenders to decide on the one which makes probably the most sense for you.

About Credible

Credible is a multi-lender market that empowers shoppers to find monetary merchandise which are the very best match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus enable shoppers to shortly examine correct, customized mortgage choices – with out placing their private data in danger or affecting their credit score rating. The Credible market gives an unmatched buyer expertise, as mirrored by over 4,500 optimistic Trustpilot opinions and a TrustScore of 4.7/5.

[ad_2]

Supply hyperlink