[ad_1]

The S&P 500 broke under 4,000 this week, for the primary time for the reason that finish of July. It has buyers questioning: Does this mark the low level of a curler coaster journey? Shares rose all final 12 months, fell from January to June, rallied from July to mid-August, and now are falling once more.

Based on Wells Fargo strategist Paul Christopher, it’s proof that the inventory rally is sputtering to a halt. Christopher writes that “Cracks in monetary market liquidity are showing,” and says of the S&P 500, “3,900 is the following key degree of assist. Beneath that brings the June intraday low of three,636 again into the dialog.”

The important thing issue right here, in Christopher’s view, is the Federal Reserve’s aggressive anti-inflation stance, and Fed chair Jerome Powell’s willpower, said in his Jackson Gap speech, to proceed elevating rates of interest till inflation is introduced beneath management.

With inflation working at 8.5%, Powell’s place implies additional fee hikes, and market watchers anticipate the Fed to implement two extra 75-basis level hikes this 12 months. That may bump the Fed’s key fee to vary of 4% to 4.25%, and improve the danger that tighter cash will tip the economic system into recession.

It will naturally deliver buyers to begin trying into defensive shares, and significantly high-yielding dividend payers. These are the usual defensive performs when markets flip south – the dividend gives some surety of an revenue stream, and in at the moment’s atmosphere, some safety in opposition to inflation.

Bearing this in thoughts, we used the TipRanks’ database to zero-in on two shares which are exhibiting excessive dividend yields – no less than 8%. Every inventory additionally holds a Sturdy Purchase consensus ranking; let’s see what makes them so engaging to Wall Road’s analysts.

Saratoga Funding Company (SAR)

We’ll begin with Saratoga Funding, a enterprise improvement company. These firms put money into, and supply credit score and different monetary providers to mid-market enterprises – small- to mid-sized corporations that will not qualify for conventional banking providers. Saratoga’s buyer base is made up of the kind of firm that has been the normal driver of the US economic system, the small companies that generate probably the most job creation.

Saratoga just lately reported its monetary outcomes for Q1 of fiscal 2023, the quarter ending on Might 31 of this 12 months. As of that date, the agency’s portfolio had a price of $894.5 million, and included investments in 45 firms. Of this whole, some 80% is first-lien time period loans, and 9.9% was widespread fairness. The rest was divided between second lien time period loans, unsecured loans, and subordinated notes.

This portfolio generated a complete funding revenue of $18.68 million within the fiscal 1Q23, up 11% year-over-year. Per share, internet funding revenue got here to 66 cents, a year-over-year achieve of 37%. With this degree of revenue, Saratoga was simply capable of cowl the Q1 dividend of 53 cents per widespread share – and actually, raised the dividend cost by 1 cent within the fiscal Q2 declaration, as much as 54 cent per widespread share. The raised dividend will likely be paid out on September 29.

On the new fee, the dividend annualizes to $2.16 per widespread share, and offers a yield of 8.8%, simply above the present fee of inflation – making the dividend excessive sufficient to make sure that SAR provides buyers a optimistic fee of actual return.

Compass Level’s 5-star analyst Casey Alexander is impressed with Saratoga’s execution in latest months, writing: “Saratoga Funding Corp has carved out a monitor report befitting a real progress BDC. SAR’s NAV has reached new all-time highs regardless of the COVID credit score cycle… With its superior progress efficiency, SAR is incomes a premium a number of of a ‘progress’ BDC. We’re sustaining our goal P/NAV a number of at 1.00x. SAR is working by way of a interval of decrease common yields in addition to a few burdened credit of their portfolio. We nonetheless anticipate SAR to commerce at a premium to SAR’s peer-group P/NAV of 0.81x, however a reduction to these BDC’s acknowledged as ‘progress’ BDCs.”

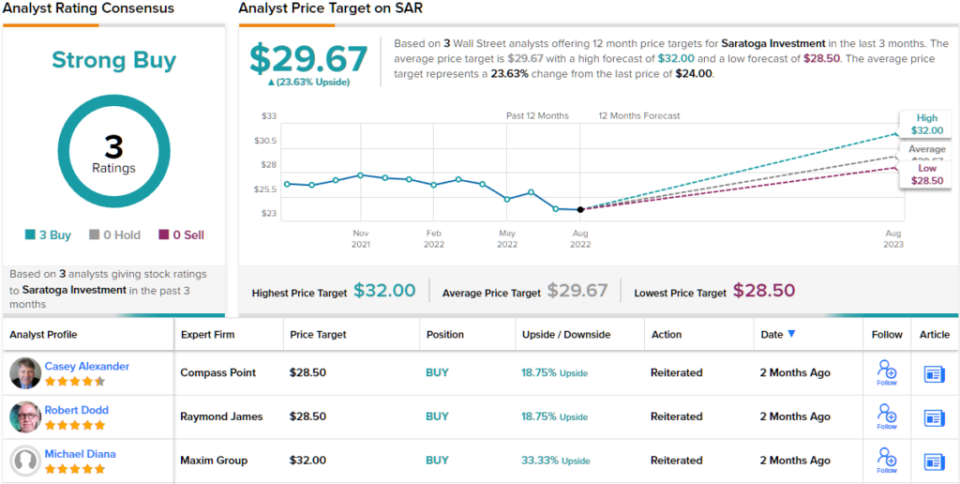

Alexander believes that this inventory will proceed to carry out for buyers, and charges it as a Purchase, with a worth goal of $28.50 indicating potential for ~19% share appreciation within the months forward. Based mostly on the present dividend yield and the anticipated worth appreciation, the inventory has ~28% potential whole return profile. (To look at Alexander’s monitor report, click on right here)

There’s some proof that that Road is consistent with the bulls right here, for whereas SAR has solely picked up Three latest analyst evaluations, all of them agree that that could be a inventory to Purchase, making the Sturdy Purchase consensus ranking unanimous. The shares are presently buying and selling for $24 and their $29.67 common goal implies a one-year upside potential of ~24%. (See Saratoga inventory forecast on TipRanks)

Crescent Capital (CCAP)

The second inventory we’ll take a look at is one other BDC, Crescent Capital. This agency directs its exercise towards non-public mid-market enterprise clients, for whom it originates loans and invests in current debt and fairness. In its lifetime, Crescent, which payments itself in its place asset supervisor, has constructed a portfolio totaling $38 billion, made up of unique loans and current debt and fairness of the goal funding base.

The majority of Crescent’s portfolio, simply over 60%, is made up of unitranche first lien loans, whereas one other 26% consists of senior secured first liens. The rest of the portfolio consists of assorted kinds of debt and fairness investments.

This portfolio supported a 2Q22 internet funding revenue of $15.5 million, 50 cents per share, with the adjusted internet funding revenue said at $12.7 million, or 41 cents per share. The corporate’s internet asset worth per share got here in at $20.69.

Buyers ought to comply with these revenue numbers, as they permit Crescent to cowl its dividend cost. The following dividend, set to be paid out on October 17, is for 41 cents per widespread share. This annualizes to $1.64, and yields a formidable 9.4%. Crescent can even pay out a beforehand introduced particular dividend of 5 cents per widespread share on September 15.

Oppenheimer analyst Mitchel Penn has been overlaying this inventory, and sees the dividend, and the corporate’s capacity to prosper even when charges go up, as key factors for buyers. He states, “Our mannequin assumes rates of interest proceed to rise and that the central financial institution doesn’t reverse course. If that did happen, administration price waivers by way of end-2023 would seemingly permit Crescent to earn sufficient to cowl the $1.64 dividend, which suggests an 7.8% ROE…. If LIBOR rises 100 bps, administration estimates that NII would seemingly rise $7.4M, or $0.24/share. After an incentive price, we estimate $0.20. We now have included a few of this fee improve in our mannequin as applicable.”

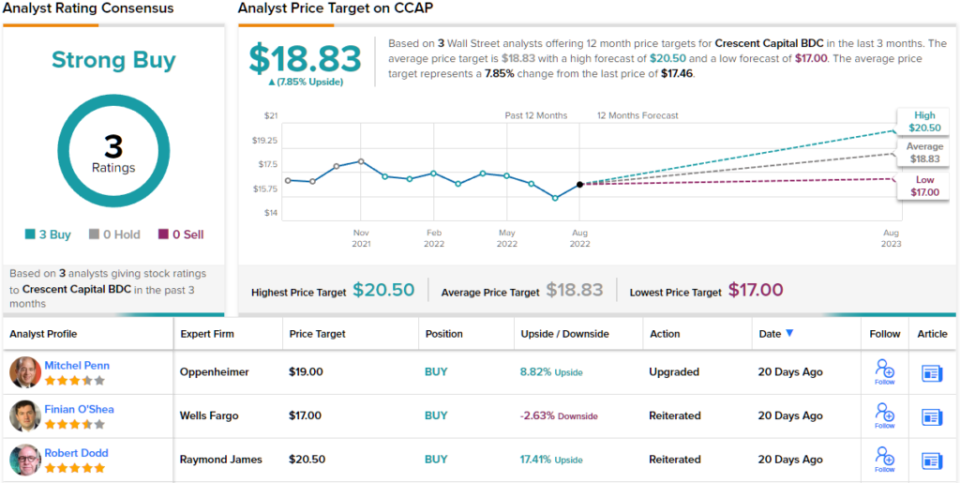

Advancing from these feedback, Penn units an Outperform (i.e. Purchase) ranking on the shares, together with a worth goal of $19, suggesting an upside of 9% by the tip of subsequent 12 months. (To look at Penn’s monitor report, click on right here)

That is one other inventory with a unanimous Sturdy Purchase consensus ranking, based mostly on Three optimistic analyst evaluations set in latest weeks. The inventory’s common worth goal of $18.83 implies ~8% upside potential from the present buying and selling worth of $17.25. (See Crescent inventory forecast on TipRanks)

To seek out good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.

[ad_2]

Supply hyperlink