[ad_1]

Our aim right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” beneath, is to provide the instruments and confidence you might want to enhance your funds. Though we do promote merchandise from our companion lenders who compensate us for our companies, all opinions are our personal.

Your credit score rating is a crucial issue in terms of qualifying for a private mortgage. Right here’s why it issues and methods to enhance your rating. (Shutterstock)

Your credit score rating impacts your skill to get a mortgage, how a lot you’ll be able to borrow, the rates of interest you’re eligible for, and typically, even whether or not you qualify to lease an condo.

Whenever you’re making use of for a private mortgage, having credit score rating may also help you get the bottom out there rates of interest. Listed here are three explanation why you need to enhance your credit score rating earlier than taking out a private mortgage.

Credible makes it straightforward to see your prequalified private mortgage charges from numerous lenders, multi functional place.

1. You could get a decrease rate of interest

Your credit score rating is without doubt one of the most vital elements that decide what rate of interest you’re eligible for if you take out a private mortgage — or any sort of mortgage. Usually talking, the higher your credit score rating, the higher the rate of interest you’ll qualify for as a result of the much less dangerous you’re in a lender’s eyes. And the greatest rates of interest are often reserved for debtors with glorious credit score.

The rate of interest you obtain on a mortgage is vital for a number of causes. First, it impacts the quantity of your month-to-month fee. It additionally determines your long-term prices, and a better rate of interest can price you hundreds of {dollars} extra over the lifetime of your mortgage than a decrease rate of interest.

2. Lenders will probably be extra more likely to approve you for a mortgage

Your credit score rating may even assist decide whether or not you qualify for a private mortgage in any respect. In case your rating is simply too low, it might point out to a lender that you could be not be capable to make your mortgage funds.

Whether or not you’re making use of for a private mortgage, a mortgage, an auto mortgage, or anything, a lender will often have a minimal credit score rating you’ll must qualify. Some lenders state this minimal rating on their web sites, whereas others don’t.

Go to Credible to examine private mortgage charges from numerous lenders, with out affecting your credit score rating.

3. You might be able to borrow extra

One more reason your credit score rating is so vital if you’re making use of for a private mortgage is that it will probably have an effect on the quantity you’re capable of borrow. The higher your credit score rating, the extra a lender trusts that you just’ll repay your mortgage. In return, they could lend you a better quantity.

Some private mortgage lenders provide loans of as much as $100,000, however larger mortgage quantities could also be reserved for debtors with glorious credit score. In the meantime, somebody with poor credit score could solely qualify to borrow a smaller quantity.

However simply since you qualify for a bigger mortgage doesn’t essentially imply you need to borrow the complete quantity. It’s vital to solely borrow what you want so that you just aren’t paying further curiosity.

What makes up a credit score rating?

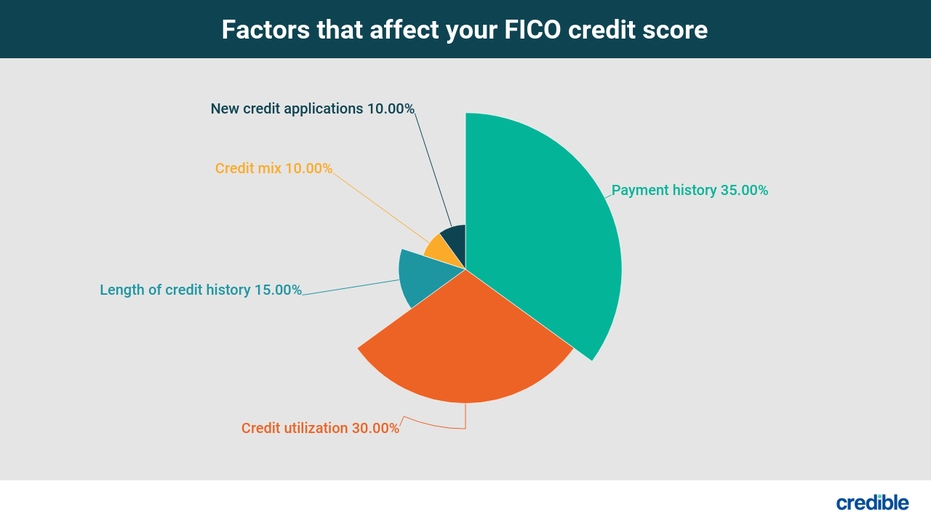

To extend your credit score rating to qualify for a private mortgage, it’s vital to know what elements have an effect on your rating. Your FICO Rating (the scoring mannequin lenders use most) is made up of 5 key classes.

- Cost historical past (35%) — Your fee historical past exhibits whether or not you’ve made your mortgage and credit score funds up to now. The higher your fee historical past, the higher your credit score rating. However, a late or missed fee may cause your credit score rating to say no.

- Credit score utilization (30%) — Your credit score utilization refers back to the share of your out there credit score that you just’re utilizing. You’ll find it by dividing the quantity of your revolving credit score that you just’re utilizing by your complete revolving credit score limits. Lenders usually favor your credit score utilization to stay beneath 30%.

- Size of credit score historical past (15%) — That is the typical age of your credit score accounts, in addition to the age of your oldest and latest accounts. It additionally exhibits how lengthy it’s been because you used sure accounts.

- Credit score combine (10%) — Your credit score combine consists of the several types of credit score in your accounts, together with bank cards, strains of credit score, and installment loans. You don’t must have considered one of every sort of credit score, however having multiple sort will be useful on your credit score rating.

- New credit score (10%) — New credit score refers to any new accounts you’ve opened. Opening a number of accounts in a brief time period is usually a unhealthy signal to lenders because it might point out that you just’re struggling to handle your debt.

Methods to enhance your credit score

In case your credit score rating isn’t fairly the place you’d prefer it to be, you are able to do a number of issues to spice up your rating earlier than you apply for a private mortgage. A few of these could yield fast outcomes, whereas others will take a bit longer:

- Examine your credit score report. Checking your credit score report may give you an concept of the place you stand and what may be maintaining your rating low, together with missed funds. Should you discover errors in your credit score report, you’ll be able to dispute them with the suitable credit score bureau. Having errors eliminated out of your report can enhance your rating.

- Pay your payments on time. Your fee historical past is crucial issue that determines your credit score rating, so it is sensible that merely paying your payments on time, each time, is one of the best ways to spice up your rating in the long term.

- Repay revolving debt. Paying off bank cards and different revolving debt can scale back your credit score utilization, which may then enhance your credit score rating.

- Improve your credit score limits. Along with decreasing your debt to enhance your credit score utilization, you may also enhance your credit score limits. You might be able to do that by calling your bank card firm or requesting a rise by means of your on-line account.

- Keep away from making use of for brand new credit score. Making use of for brand new credit score proper earlier than you apply for a private mortgage may end up in a small hit to your credit score rating, which may briefly decrease your rating by a couple of factors.

Should you’re prepared to use for a private mortgage, Credible enables you to shortly and simply examine private mortgage charges to search out one which most accurately fits your wants.

[ad_2]

Supply hyperlink